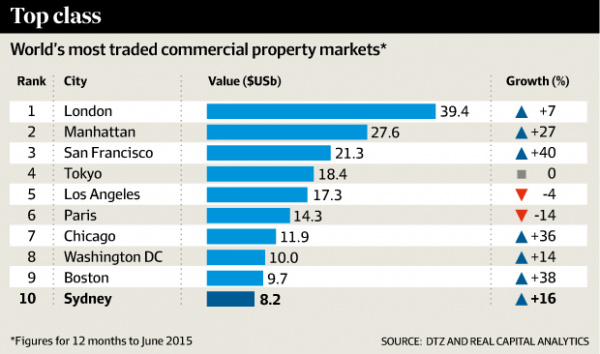

Sydney has recently been ranked the tenth most traded commercial real estate investment market in the world! Logistic facilities, shopping centres, and offices have seen huge investments from overseas, largely from China and the focus has been mostly in Sydney. Sydney received more commercial real estate investment than Hong Kong and Singapore last financial year according to an article in the Financial Review lagging only slightly behind Tokyo for the top spot. It’s no wonder prices in Sydney have surged. The increased investment in commercial property can help to explain the recent bubble in housing prices.

Low interest rates around the world have driven overseas investment in Australian property and the falling Australian dollar has made investment particularly attractive. Commercial property investment in Sydney is not predicted to slow down any time soon, with little change in the cash price of major global economies and no sign of support for the Australian dollar. There is a risk however that the slowing Chinese economy and the devaluation of the yuan will stifle investment in time. However, with some of the highest yields in the world (6% for Sydney’s commercial property market) and a vacancy rate of 7%, Sydney is hard to ignore if you are an overseas investor.