Whilst other parts of the economy such as resources might be flailing, the commercial property market in Australia is booming and looks to continue this trend throughout 2016. The health of the commercial property industry is a good indicator for the health of the real economy, alongside job growth and employment figures. Despite the fact that government revenue in Australia is in decline from a cyclical drop in commodity prices (oversupply / under-demand), the real economy in non resource based economies like Melbourne and Sydney is flourishing. The Financial Review has predicted that there will be 30 billion dollars worth of commercial property purchases in 2016 alone.

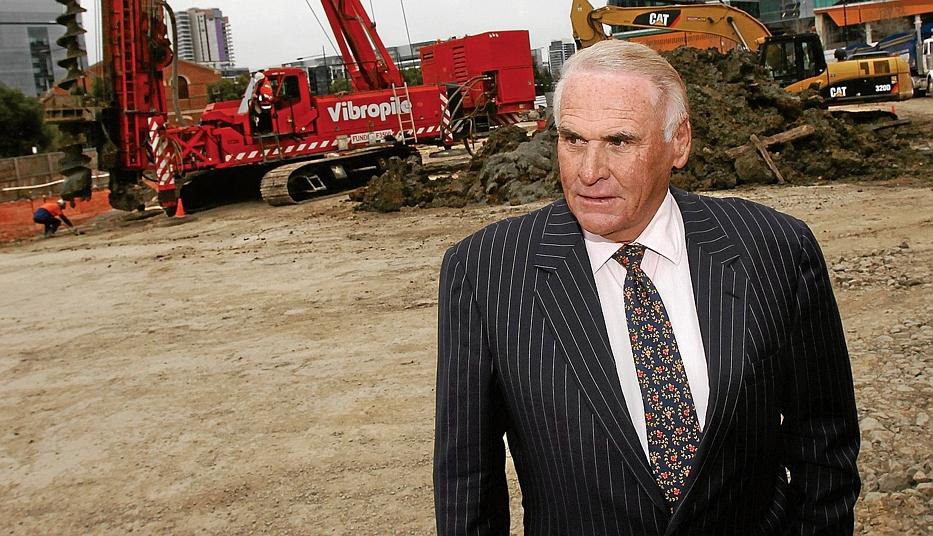

Property developer Lang walker is hoping to get more than 2.5 billion dollars for the Collins Square Project in Melbourne. If this sale takes place, it will be the largest single sale that Australia has seen in the industry. China has been the largest investor in the Australian commercial property market over the last decade and the trend is not likely to cool, despite the slowing of the Chinese economy. China’s GDP has been slowing from it’s peak in 2007 with growth in 2015 at just 6.9%, the slowest in 25 years.

Despite concerns over China’s growth, 6.9% is a considered very strong for a developed country. China hasn’t gone into free fall overnight, they of have been through a slow reduction in GDP growth as you would expect to happen when a healthy developing economy progresses into a developed economy.