Small businesses can now “immediately deduct assets costing less than $20,000 purchased since 7.30pm 12th May 2015.” according to the Australian Taxation Office. This is a huge increase from the previous instant asset write-off threshold of $1,000.

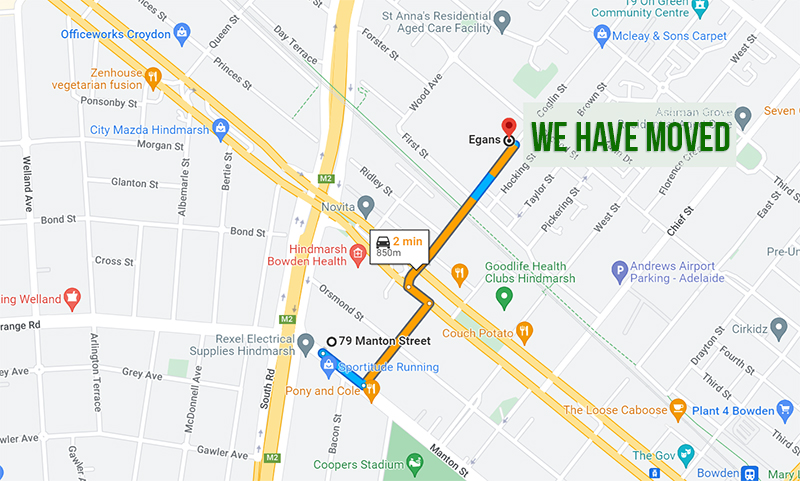

This means that you can fitout your entire office with Egans workstations and associated office furniture and write-off the fitout immediately if you are a small business. Forget the days of slowly deducting your assets over the course of years using a small business pool.

You can even retrospectively write off any assets purchased after 7:30pm 12th May 2015.

You can do this with multiple assets, as the $20,000 mark is per asset.

The ATO is also recognising second hand assets within this category, we think because they understand the social and environmental benefits of buying second hand. Thus, the tax concession applies to all furniture acquired through our Wise Office Furniture Program.